Truck Finance Broker

Table of ContentsTruck Finance BrokerHorizon Finance GroupHorizon Finance Group Car Finance BrokerHorizon Finance Group Truck Finance BrokerEquipment Finance

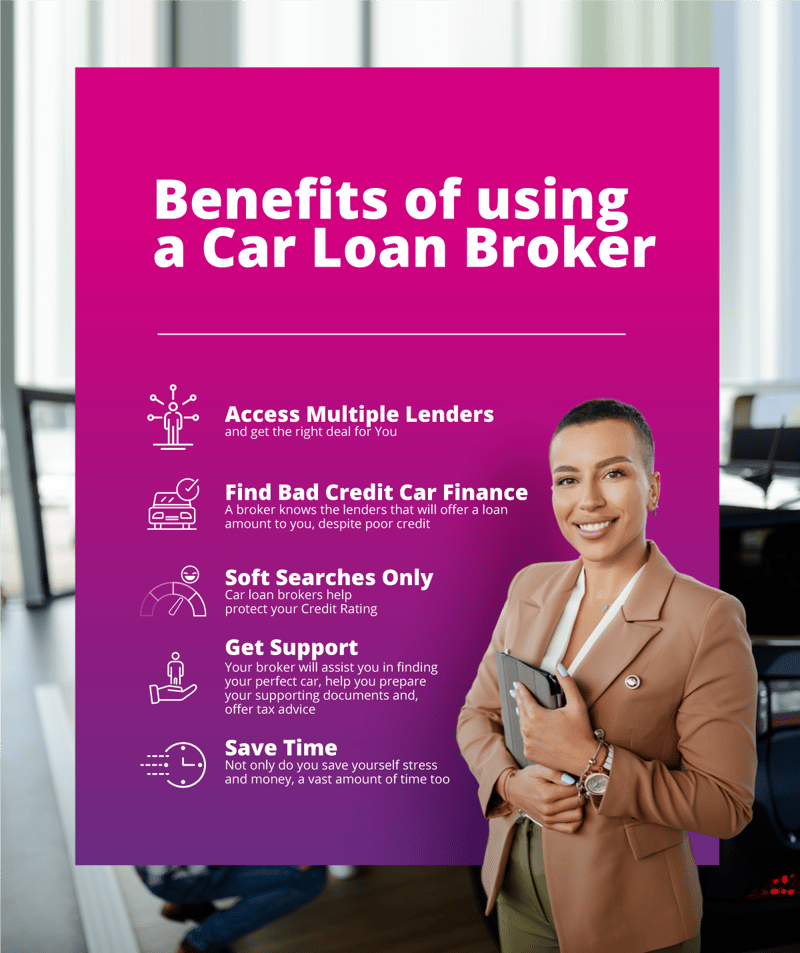

An excellent broker works with you to: Understand your needs and also goals., attributes and fees). Apply for a finance as well as take care of the process with to negotiation.Some brokers earn money a standard cost no matter of what car loan they advise. Other brokers obtain a greater charge for using certain fundings. Often, a broker will certainly charge you a cost straight instead of, or in addition to, the lender's commission. If you're uncertain whether you're obtaining a bargain, ask around or look online to see what various other brokers charge.

Look the following lists on ASIC Link's Professional Registers: Credit Rep Credit Licensee To browse, select the checklist name in the 'Select Register' drop-down menu. If the broker isn't on one of these listings, they are operating illegally. Consider your must-haves and also nice-to-haves Prior to you see a broker, assume concerning what matters most to you in a mortgage.

Horizon Finance Group

Make a checklist of your: 'must-haves' (can not do without) 'nice-to-haves' (could do without) See picking a mortgage for advice on what to think about. Discovering a home loan broker You can find a qualified home mortgage broker via: a mortgage broker specialist organization your lending institution or banks recommendations from individuals you know Meeting a home mortgage broker Bring your list of must-haves and nice-to-haves.

Obtain them to explain exactly how each funding choice works, what it costs as well as why it's in your ideal rate of interests. If you are not delighted with any type of option, ask the broker to locate alternatives.

A home mortgage is a long-lasting financial debt, so also a little distinction in interest builds up gradually. If you can get a lower rate of interest from another loan provider, you can conserve hundreds of bucks. Inquiries to ask your mortgage broker Ask concerns. Great deals of them. For instance: Do you use finances from a variety of different lenders? What type of lenders do you collaborate with? What type of lenders can not you accessibility? How do you make money for the recommendations you're offering me? Does this differ between loan providers? Why did you Full Report recommend this funding to me? Why is this funding in my benefits? What costs will I have to pay when getting this finance? What features (options) feature this lending? Can you reveal me how they function? How do the fees as well as attributes of this funding affect how much the funding will cost me? Can you show me a pair extra alternatives, including one with the least expensive cost? What is the limit for loan provider's home mortgage insurance (LMI) and also exactly how can I avoid it? Obtain a created quote from the broker A created quote informs you the: sort of funding lending quantity car loan term (period) present rate of interest costs you need to pay (for example, broker's cost, lending application charge, continuous charges) Make certain you're comfy with what you're accepting.

Truck Finance Broker

Never ever sign empty forms or leave details for the broker to fill in later on. Troubles with a home loan broker If you're miserable with the funding recommendations you've gotten or costs you've paid, there are steps you can take.

Price/interest price is an essential facet of the car loan, the broker worth proposition corresponds to dramatically even more than simply Click This Link ensuring that the customer obtains a competitive passion price for their offered circumstances. Brokers provide an unique combination of choice, convenience, customised solution and recommendations with the expense of that consumer's intro paid by the loan provider.

Car Finance Broker

Many consumers might not realize that in addition to mortgage, Finance Brokers can help with company finances, automobile fundings, remodelling financings and even wedding celebration lendings - Horizon Finance Group Equipment finance.

With many various economic terms to keep track of, it's not always understandable the different roles and moving components of the economic sector. What is a money broker, click now as well as what do these people do? While a home loan broker concentrates on home financings, a finance broker concentrates on a selection of different car loans.

A financing broker could be the secret to discovering what you're looking for. What Is a Finance Broker?

Horizon Finance Group Equipment Finance

Finance brokers work with financial institutions, credit scores unions, and also other financial organizations to function in both the lending institution as well as the client's ideal rate of interests. Why Make Use Of a Money Broker? Why might you make use of a financing broker?